Table of Contents

INTRODUCTION

IPOs, Ya Initial Public Offerings, Ek Mahatvapurna Charan Hote Hain Kisi Bhi Company Ke Vikas Path Par, Jo Unhe Public Se Fund Raise Karne Ka Avsar Pradan Karta Hai. Yeh Lekh IPO Ke Antargat Aane Wale Vividh Charanon, Jaise Ki Promoter Holding, Angel Investors, Venture Capital Firms, Private Equity, Aur Ant Mein IPO Ki Process, Ke Bare Mein Vistar Se Jankari Pradan Karta Hai. Iske Alawa, Yeh Lekh Companies Dwara IPO Lane Ke Karanon, IPO Mein Invest Karne Ki process, Aur IPO Se Judi Various Strategies Aur Tips Ko Bhi Cover Karta Hai, Jo Investors Ko Informed Decisions Lene Mein Madadgar Sabit Hote Hain.

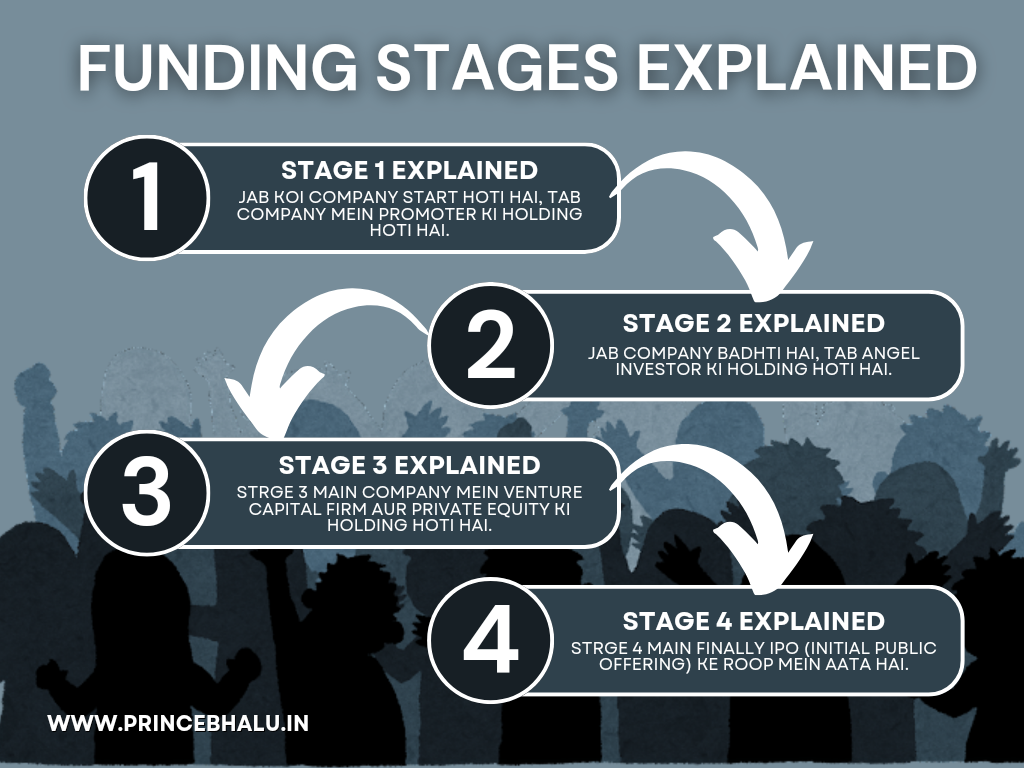

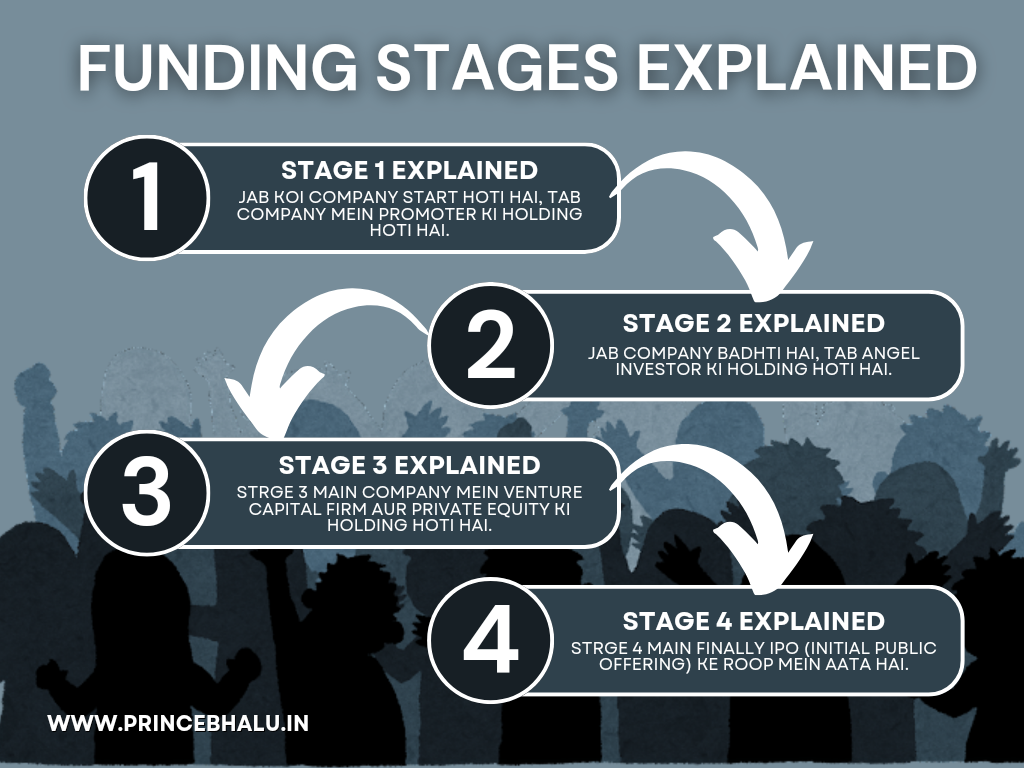

FUNDING STRATEGIES EXPLAINED

STRGE 1 :

Jab Koi Company Start Hoti Hai, Tab Company Mein Promoter Ki Holding Hoti Hai.

STRGE 2 :

Jab Company Badi Ho Jati Hai, Tab Company Mein Angel Investor Ki Holding Hoti Hai.

STRGE 3 :

Strge 3 Main Company Mein Venture Capital Firm Aur Private Equity Ki Holding Hoti Hai.

STRGE 4 :

Strge 4 Main Finally IPO (Initial Public Offering) Aata Hai.

METHODS OF RAISING FUNDS

1. DEBT

Iska Matlab Hai Udhaar Ya Karz. Companies Ya To Public Banks Se Ya Private Banks Se Money Udhaar Le Sakti Hain. Isme, Company Ko Diye Gaye Money Par Ek Nirdharit Interest Rate Chukani Padti Hai. Debt Ka Fayda Yeh Hai Ki Company Ko Apne Equity Shares Bechni Nahi Padti, Isliye Company Ke Malikana Adhikar Mein Koi Kami Nahi Hoti.

2. EQUITY

Jab Koi Company Public Ko Apne Shares Bechti Hai Jise IPO Kahate Hai‚ Tab Woh Equity Ke Zariye Se Money Jutati Hai. Is Tarah Ke Fund Raise Karne Par, Investors Ko Company Mein Hissedari Milti Hai, Yani Ki Woh Company Ke Partial Owners Ban Jate Hain. Equity Se Money Uthane Ka Ek Bada Fayda Yeh Hai Ki Company Par Money Wapas Karne Ka Koi Sidha Dabav Nahi Hota, Jaise Ki Debt Mein Hota Hai, Lekin Isse Company Ka Control Kuch Had Tak Shareholders Ke Paas Chala Jata Hai.

Pratyek Method Ka Apna-apna Profit Aur Loos Hai, Aur Companies Apne Financial Goals, Market Conditions, Aur Company Ki Need Ke Aadhar Par Money Jutati Hain. Companies Inme Se Kisi Ek Ya Dono Types Ka Use Karti Hain.

WHY COMPANIES GO FOR AN IPO

Koi Bhi Company IPO Kyun Lati Hai ? Jab Kabhi Bhi Company Ko Apna Business Growth Karna Hota Hai, Ya Kisi Bhi Reason Se Apni Company Ko Develop Karna Hota Hai, Aur Jab Company Par Debt Hota Hai, Company Mein Angel Investors, Venture Capital Firms, Aur Private Equity Ki Holdings Hoti Hain. Ye Investors Apni Holdings Ko Company Se Exit Karna Chahte Hain. Tab Company Apna IPO Issue Karta Hai. IPO Ko Initial Public Offering Kehte Hain.

IPO QUOTAS

IPO Main Kitna Quota Kiske Liye Reserve Rahta Hai.

1. QIB

IPO Main First Quota QIB Ke Liye Reserve Hota Hai. QIB (Qualified Institutional Buyers) Ke Liye IPO Mein 50% Quota Reserve Hota Hai. Qib (Qualified Institutional Buyers) Mein Banks, Insurance Companies, Pension Funds, Aur Mutual Funds Aate Hain.

2. NII

IPO Mein Second Quota Nii, Yaani Non-institutional Investors Ke Liye Reserve Rehta Hai. Nii Ke Liye 15% Quota Reserve Hota Hai. Non-institutional Investors Unhe Kaha Jata Hai Jo IPO Mein 2 Lakh Se Zyada Money Lagate Hain.

3. RETAIL

IPO Mein Third Quota Retail Ke Liye Reserve Rahta Hai. Retail Ke Liye 35% Quota Reserve Hota Hai. Retail Investors Woh Hote Hain Jo IPO Mein 2 Lakh Se Kam Money Lagate Hain.

Profit Making Companies Jab IPO Laati Hain, Tab Retail Ke Liye 35% Reserve Hota Hai.

Agar Loos Making Company IPO Laati Hai, Tab Retail Ke Liye 10% Reserve Hota Hai.

PROMOTER HOLDING

Jis Company Ko IPO Laana Hota Hai, Us Company Ki Minimum Promoter Holding 20% Honi Chahiye. IPO Ke 3 Saal Tak, Company Ko 20% Promoter Holding Maintain Karni Hoti Hai.

IPO LISTING

Company Ko IPO Lane Ke Liye, IPO Ko Stock Market Ke Exchanges NSE Aur BSE (Ek Mein Ya Dono Mein) Mein List Karwana Hota Hai.

IPO APPLICANTS

IPO Mein Mainay Two Types Ke Person Apply Karte Hain.

1. SPECULATORS

Speculators Ve Hote Hain Jo Ummeed Karte Hain Ki IPO Premium Par List Hoga. Jab IPO Premium Par List Hota Hai, Tab Speculators IPO Ko Sell Karke Profit Book Karte Hain.

2. INVESTORS

Investors Ve Hote Hain Jo Long Term Ke Liye IPO Mein Invest Karte Hain.

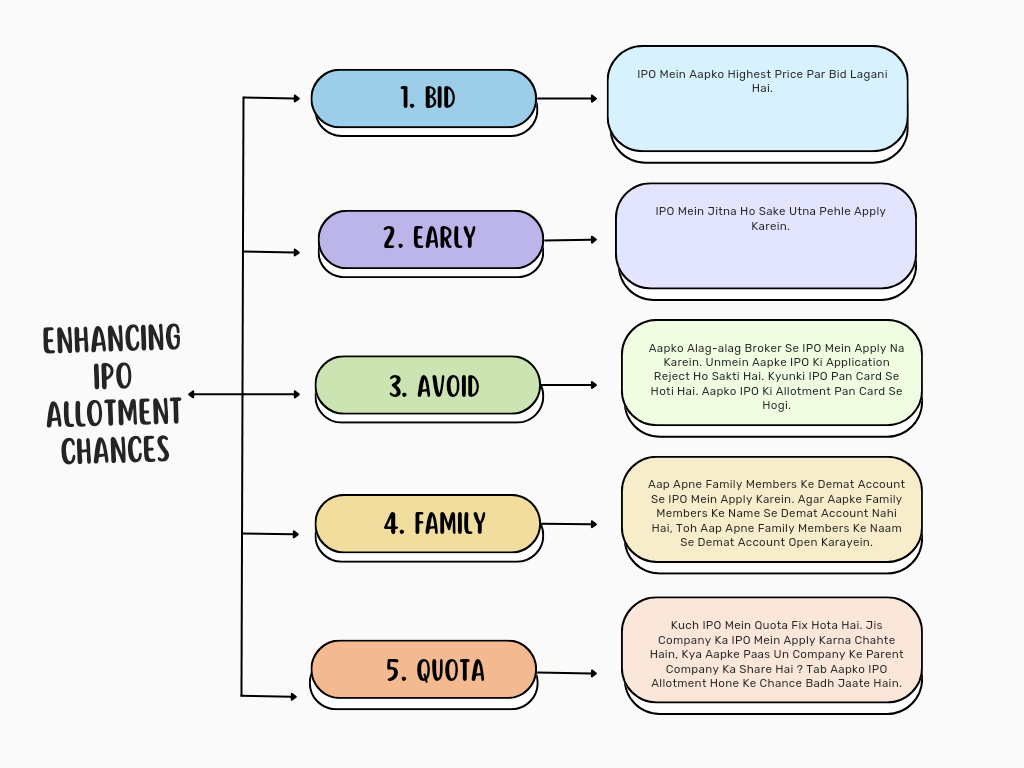

ENHANCING IPO ALLOTMENT CHANCES

Company Ke IPO Two Types Se Aate Hain :

1. FIXED PRICE

2. BOOK BUILDING ISSUE

Zyadatar IPO Book Building Issue Ke Zariye Aate Hain.

Book Building Issue Ke IPO Mein Aapko Bid Lagani Hoti Hai. Is Tarah Ke IPO Mein Ek Minimum Price Aur Ek Highest Price Hoti Hai.

IPO Mein Maximum 20% Ka Hi Gap Ho Sakta Hai. 20% Se Zyada Gap Nahi Ho Sakta.

- IPO Mein Aapko Highest Price Par Bid Lagani Hai.

- IPO Mein Jitna Ho Sake Utna Pehle Apply Karein.

- Aapko Alag-alag Broker Se IPO Mein Apply Na Karein. Unmein Aapke IPO Ki Application Reject Ho Sakti Hai. Kyunki IPO Pan Card Se Hoti Hai. Aapko IPO Ki Allotment Pan Card Se Hogi.

- Aap Apne Family Members Ke Demat Account Se IPO Mein Apply Karein. Agar Aapke Family Members Ke Name Se Demat Account Nahi Hai, Toh Aap Apne Family Members Ke Naam Se Demat Account Open Karayein.

- Kuch IPO Mein Quota Fix Hota Hai. Jis Company Ka IPO Mein Apply Karna Chahte Hain, Kya Aapke Paas Un Company Ke Parent Company Ka Share Hai ? Tab Aapko IPO Allotment Hone Ke Chance Badh Jaate Hain.

BUYING IPO SHARES

IPO Mein Aap Shares Ko Directly Nahi Buy Kar Sakte Hain. IPO Mein Aapko Lot Size Mein IPO Ko Buy Karna Padta Hai, Jaise 1 Lot, 2 Lot, Aise Hi. Alag-alag IPOs Mein Alag-alag Quantity Mein Shares Hote Hain.

EMPLOYEE PARTICIPATION

Jis Company Ka IPO Hota Hai, Us Company Ke Employees Kam Se Kam 5 Lakh Rupees Tak Hi Unke IPO Mein Invest Kar Sakte Hain. Usse Jyada Unke IPO Mein Invest Nahi Kar Sakte Hain.

INVESTING IN AN IPO

Jab Aap IPO Mein Money Lagate Hain, Toh Agar Company Ko Profit Hota Hai, Tab Aapko Bhi Profit Hota Hai. Aur Agar Company Ko Loss Hota Hai, Us Case Mein Aapka Bhi Loss Hota Hai.

Agar Aapne IPO Mein Money Lagaya Aur Wo IPO Aapko Allot Ho Gaya, To Agar Wo IPO Premium Par List Hota Hai, Tab Aapko Profit Hota Hai. Agar IPO Discount Par List Hota Hai, Tab Aapko Loss Hota Hai.

Aapko Long Term Ke Liye Money Invest Karna Hai To Aap Achhi Company Ke IPO Mein Invest Kar Sakte Hain. IPO Mein Short Term Mein Adhik Profit Hota Hai. IPO Mein Aap Invest Karte Hain, Tab Aapko Adhiktar Profit Hi Hota Hai.

INVESTMENT TIPS

Sabhi IPO Achhe Nahi Hote, Aapko IPO Mein Aane Wali Company Ki Fundamental Analysis Karni Hogi. Aap Sabhi IPO Mein Apply Na Kare.

Koi Bhi Company IPO Kyun Lana Chahti Hai, Ye Research Karo. Agar Woh Pehle Se Profit Mein Hai Aur Company Ko Expand Karna Hai, Tab Aap Us IPO Mein Apply Kare.

Agar Koi Bhi Company Pehle Se Hi Loss Mein Hai Aur Vo Apne IPO Se Apna Debt Chukana Chahti Hai, Aur Pehle Ke Investors Us Company Se Nikalna Chahte Hain, To Aise Company Ke IPO Mein Apply Nahi Karna Chahiye.

Jab Koi IPO Aata Hai, To Unki Company Advertising Par Crores Rupaye Kharch Karti Hai.

IPO Mein High Risk Hota Hai Kyonki Jo IPO Aane Wale Hote Hain, Unka Adhik Data Nahi Hota. Jo Shares Pehle Se List Ho Chuke Hain, Ve Shares Kam Risk Wale Hote Hain Kyonki Un Shares Ka Adhik Data Hota Hai.

IPO FAIL

Agar IPO 90% Se Kam Subscribe Hota Hai, Tab Vo IPO Crash Ho Jata Hai, Yaani Ki IPO Fail Ho Jata Hai. Tab IPO Mein Jitna Money Aaya Tha, Usko Wapas Dena Padta Hai.

IPO ALLOTMENT PROCESS

Jab Kisi IPO Me Over-subscription Hota Hai, Tab Sabko IPO Allotment Nahi Hota. Jis Company Ka IPO Hota Hai, Uski IPO Allotment Ki Process Hoti Hai.

IPO Mein Aapne Agar ₹245 Ka Bid Lagaya Tha Lekin Ant Mein ₹240 Ka Final Price Aaya Hai, To Aapko IPO ₹240 Ke Hisab Se Mil Jayega, Bhale Hi Aapne ₹245 Ka Bid Lagaya Ho. Agar Aapne IPO Mein ₹235 Ka Bid Price Lagaya Tha Aur IPO Ka Final Price ₹240 Aaya, Tab Aapko IPO Allotment Nahi Milega.

Agar IPO Zyada Subscribe Ho Jata Hai, Tab Company Lucky Draw Karti Hai. Ismein Kuch Person Ko IPO Allotment Milta Hai Aur Kuch Ko Nahi Milta. Ye Lucky Draw Computerized Tarike Se Kiya Jata Hai.

IPO LISTING GAINS

IPO Mein Kitna Listing Gain Hoga, Ye Investment Bank Karta Hai, Jo IPO Ki Process Karwata Hai.

IPO Ki Demand Zyada Hai, Tab IPO Listing Gain Zyada Hoga. IPO Ki Demand Kam Hai, Tab IPO Listing Gain Kam Hoga.

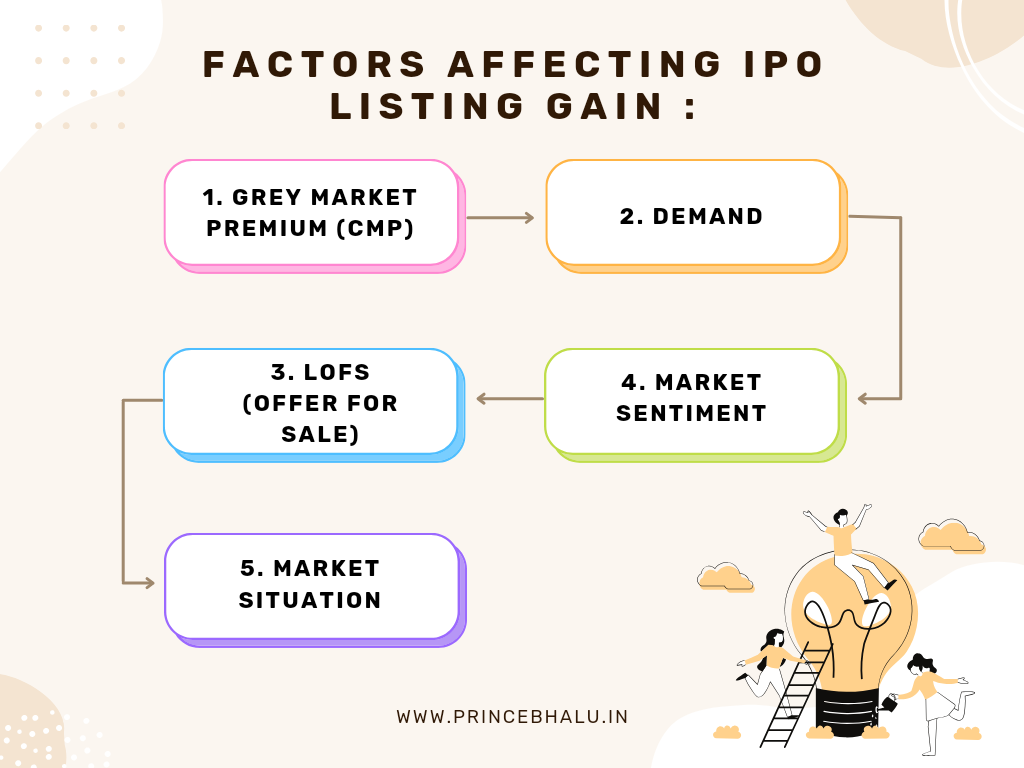

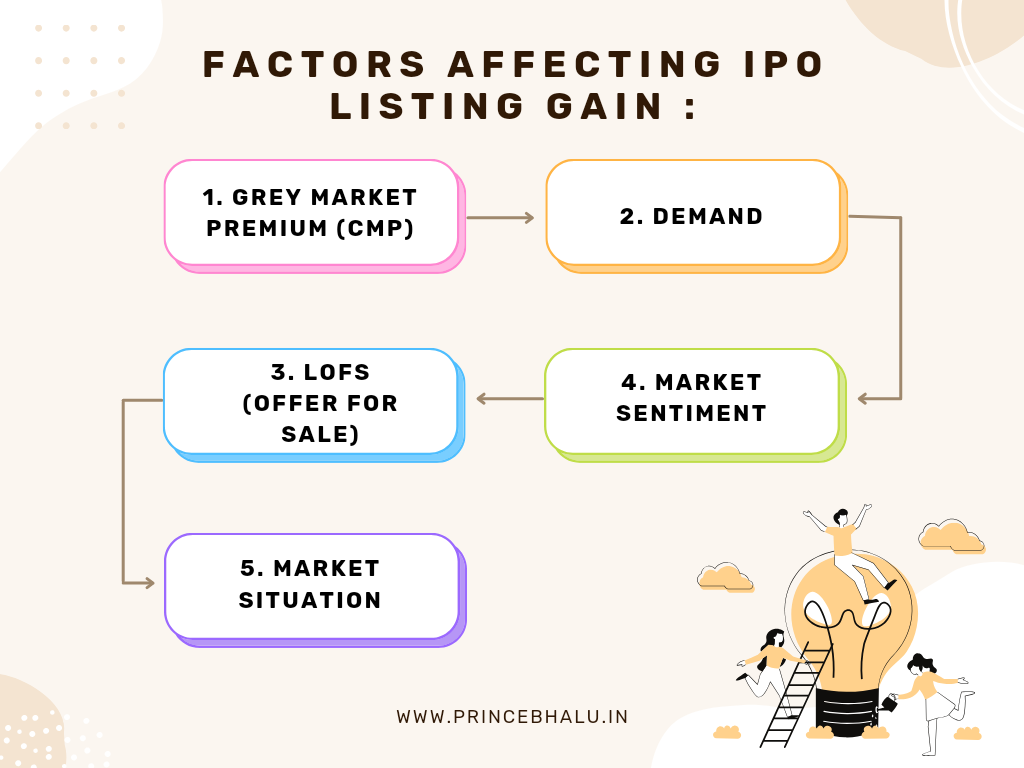

FACTORS AFFECTING IPO LISTING GAIN

1. Grey Market Premium (Cmp)

2. Demand

3. Lofs (Offer For Sale)

4. Market Sentiment

5. Market Situation

Ye Sab Factors Se IPO Mein Listing Gain (Share Ki Price) Ki Calculation Hoti Hai.

Agar Aapko IPO Mein Invest Karna Hai, To Aapko Company Ke Do Documents Read Karne Chahiye:

1. DRHP

2. RHP

Aap Rhp Par Zyada Focus Karein.

Jo IPO Zyada Subscribe (2x, 5x, 10x) Hota Hai, Vah IPO Accha Hota Hai.

CONCLUSION

IPO ek jatil lekin rewarding process ho sakti hai, jo niveshakon ko company ke vikas mein sahbhagi banne ka avsar deti hai. Chahe aap ek speculative investor hain jo short-term gains ki talash mein hain ya ek long-term investor jo company ke future mein vishwas rakhte hain, IPOs aapko ek diversify kiya hua investment portfolio banana ka avsar dete hain. Important yeh hai ki niveshak ko IPO mein invest karne se pehle thorough due diligence karna chahiye, jisme company ke fundamentals, market conditions, aur IPO ki timing ka analysis shamil hai. Iske atirikt, IPO allotment process aur listing gains jaise mahatvapurna aspects par bhi gaur karna chahiye. Ant mein, sahi jankari aur saavdhan planning se, IPOs niveshakon ke liye labhdayak sabit ho sakte hain, lekin yeh zaroori hai ki ve high risk ko bhi samjhein jo is prakar ke nivesh ke saath aata hai.