Table of Contents

INTRODUCTION

Mutual Funds Ek Type Ka Investment Option Hai Jo Un Logon Ke Liye Suitable Hai Jo Apne Busy Schedules Ke Karan Apne Investments Par Regular Nazar Nahi Rakh Sakte Hain. Ismein Investment Karna Aasan Hai Aur Regular Tracking Ki Zarurat Nahi Hoti.

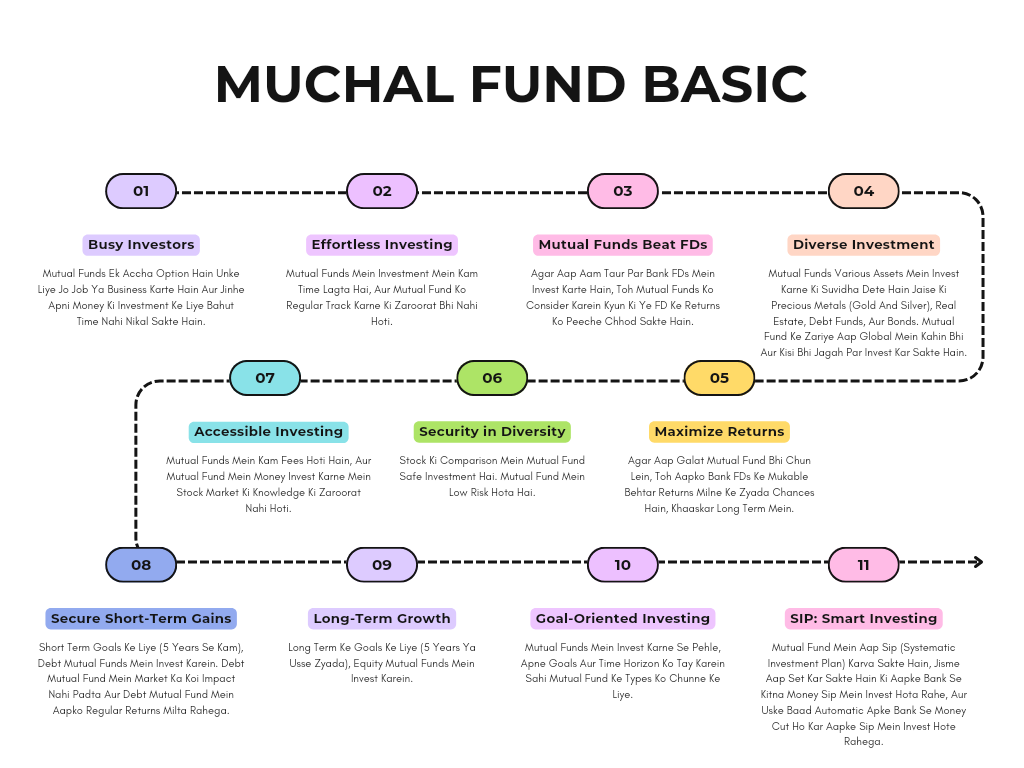

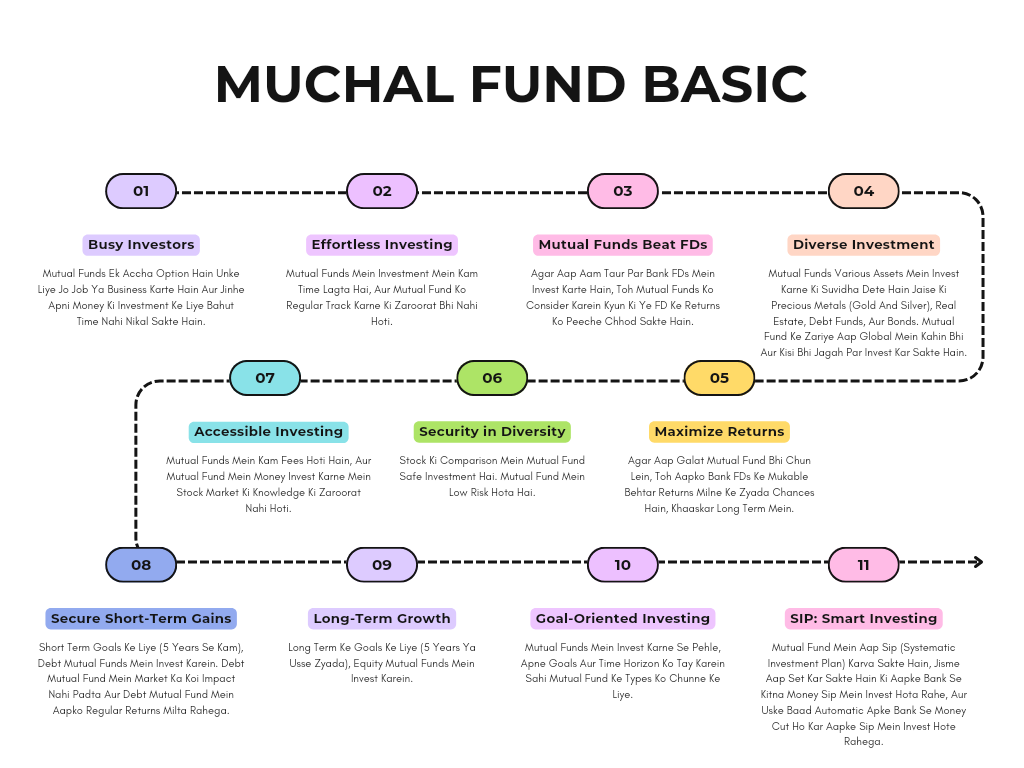

MUCHAL FUND BASIC

- Mutual Funds Ek Accha Option Hain Unke Liye Jo Job Ya Business Karte Hain Aur Jinhe Apni Money Ki Investment Ke Liye Bahut Time Nahi Nikal Sakte Hain.

- Mutual Funds Mein Investment Mein Kam Time Lagta Hai, Aur Mutual Fund Ko Regular Track Karne Ki Zaroorat Bhi Nahi Hoti.

- Agar Aap Aam Taur Par Bank FDs Mein Invest Karte Hain, Toh Mutual Funds Ko Consider Karein Kyun Ki Ye FD Ke Returns Ko Peeche Chhod Sakte Hain.

- Mutual Funds Various Assets Mein Invest Karne Ki Suvidha Dete Hain Jaise Ki Precious Metals (Gold And Silver), Real Estate, Debt Funds, Aur Bonds. Mutual Fund Ke Zariye Aap Global Mein Kahin Bhi Aur Kisi Bhi Jagah Par Invest Kar Sakte Hain.

- Agar Aap Galat Mutual Fund Bhi Chun Lein, Toh Aapko Bank FDs Ke Mukable Behtar Returns Milne Ke Zyada Chances Hain, Khaaskar Long Term Mein.

- Stock Ki Comparison Mein Mutual Fund Safe Investment Hai. Mutual Fund Mein Low Risk Hota Hai.

- Mutual Funds Mein Kam Fees Hoti Hain, Aur Mutual Fund Mein Money Invest Karne Mein Stock Market Ki Knowledge Ki Zaroorat Nahi Hoti.

- Short Term Goals Ke Liye (5 Years Se Kam), Debt Mutual Funds Mein Invest Karein. Debt Mutual Fund Mein Market Ka Koi Impact Nahi Padta Aur Debt Mutual Fund Mein Aapko Regular Returns Milta Rahega.

- Long Term Ke Goals Ke Liye (5 Years Ya Usse Zyada), Equity Mutual Funds Mein Invest Karein.

- Mutual Funds Mein Invest Karne Se Pehle, Apne Goals Aur Time Horizon Ko Tay Karein Sahi Mutual Fund Ke Types Ko Chunne Ke Liye.

- Mutual Fund Mein Aap Sip (Systematic Investment Plan) Karva Sakte Hain, Jisme Aap Set Kar Sakte Hain Ki Aapke Bank Se Kitna Money Sip Mein Invest Hota Rahe, Aur Uske Baad Automatic Apke Bank Se Money Cut Ho Kar Aapke Sip Mein Invest Hote Rahega.

WHAT ARE MUTUAL FUNDS ? HOW DO MUTUAL FUNDS WORK ?

Mutual Fund Ek Investment Option Hai, Jisme Bahut Se Person Milke Money Invest Karte Hain. Iss Fund Mein Jo Money Ekattha Hota Hai, Usse Amc (Asset Management Company) Ke Professional Managers Apne Stock Market Ke Knowlege Aur Experience Ke Sath Invest Karte Hain, Jo Fund Ke Types Ke Hisab Se Hota Hai. Invest Karne Par Investors Ko Dividends, Interest, Aur Capital Gains Milte Hain. Jo Mutual Fund Mein Invest Karte Hain, Unhe Apne Money Ke Hisab Se Mutual Fund Ke Units Milte Hain, Aur Unke Hisaab Se Jo Profit Hota Hai, Vo Investor Ke Beech Mein Baat Diya Jata Hai.

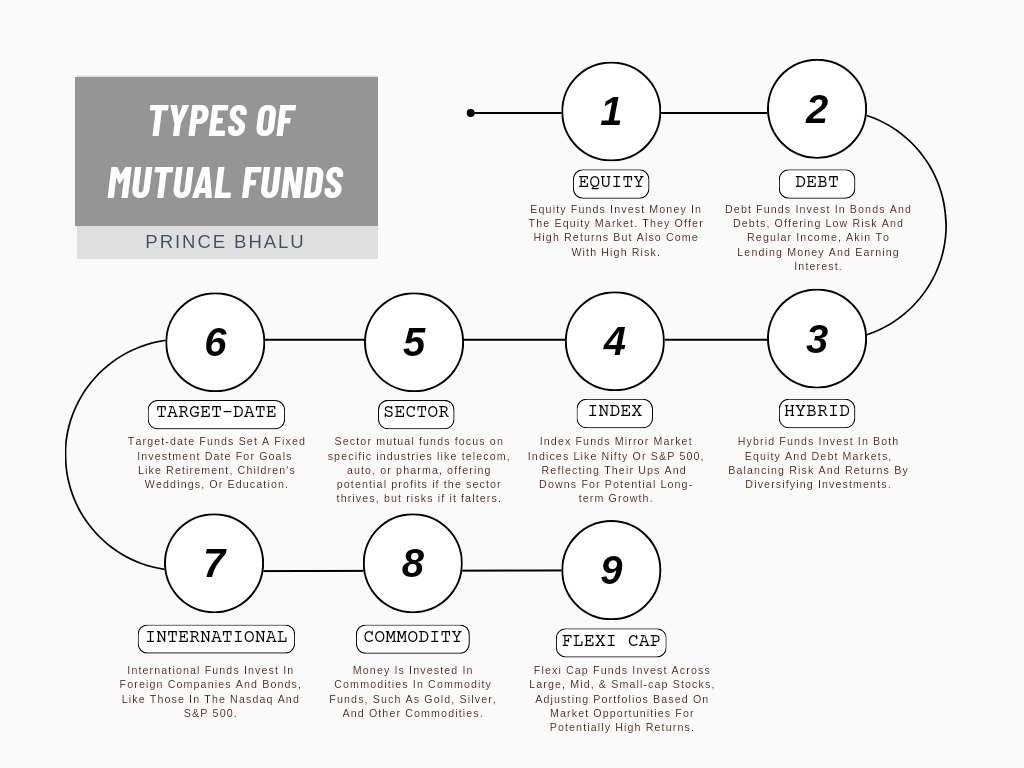

TYPES OF MUTUAL FUNDS

1. EQUITY FUNDS

Equity Funds Mein Equity Market Mein Money Invest Hota Hai. Inmein High Returns Milte Hain Lekin High Risk Bhi Hota Hai.

2. DEBT FUNDS

Debt Funds Mein Zyadatar Bonds, Securities, Aur Corporate Debt Mein Money Invest Hota Hai. Inmein Low Risk Hota Hai. Debt Funds Se Regular Income Milti Rahti Hai. Jab Aap Debt Mutual Fund Mein Invest Karte Hain, To Samjho Ki Aapne Kisi Ko Loan Par Money Diya Hai. Aur Is Loan Par Interest Rate Milta Hai.

3. HYBRID FUNDS

Hybrid Funds Mein Equity Funds Aur Debt Funds Dono Mein Money Invest Hota Hai. Hybrid Funds Mein Kuch Money Equity Market Mein Invest Hota Hai Aur Kuch Money Debt Market Mein Invest Hota Hai.

4. INDEX FUNDS

Index Funds Mein Market Index Mein Money Invest Hota Hai, Jaise Ki Nifty 50, Sensex, S&P 500, Nasdaq. Agar Aapne Index Funds Mein Money Invest Kiya Hai, To Jab Voh Index Badta Hai, Tab Aapka Mutual Fund Ka Portfolio Profit Dikhayega; Agar Voh Index Girta Hai, Tab Aapka Mutual Fund Ka Portfolio Loss Dikhayega.

Jab Aap Index Fund Mein Money Invest Karte Hain, To Short Term Mein Kuch Kah Pana Mushkil Hai, Lekin Long Term Mein Market Badhta Hi Hai. Market Mein Crash Aata Hai, Tab Market Recover Hota Hai, Jaisa Humne Stock Market Ki History Se Dekha Hai.

5. SECTOR FUNDS

Sector Mutual Fund Mein Specific Sectors Mein Money Invest Hota Hai. Sector Ke Examples Dekhe To Telecom Sector, Auto Sector, Aur Pharma Sector In Types Ke Sectors Hote Hain.

Agar Kisi Specific Sector Ke Mutual Fund Mein Money Invest Kiya Hai, Aur Voh Sector Ka Index Badhta Hai, To Aapka Profit Hota Hai; Agar Voh Sector Niche Aata Hai, To Aapka Loss Hota Hai.

6. TARGET-DATE FUNDS

Target-date Funds Mein Investor Ka Money Invest Karne Ki Date Fix Hoti Hai. Investor Ka Invest Karne Ka Reason, Jaise Retirement Ki Umar Tak, Baccho Ki Shaadi Tak, Aur Baccho Ki Education Ke Liye Hota Hai.

7. INTERNATIONAL FUNDS

International Funds Ka Matlab Hota Hai Doosre Country Ki Company Aur Doosre Country Ke Bond Mein Money Invest Karna. Aapka Money International Funds Ke Mutual Fund Mein Invest Hota Hai, Tab Aapka Money Doosre Country Ke Company Mein Aur Doosre Country Ke Bond Mein Invest Hota Hai. International Funds Mein Nasdaq Aur S&P 500 Jaise International Funds Aate Hain.

8. COMMODITY FUNDS

Commodity Funds Mein Money Commodity Mein Invest Hoti Hai. Jaise Ki Gold, Silver, Aise Commodities Mein Money Invest Hoti Hai.

9. FLEXI CAP FUNDS

Flexi Cap Funds Mein Money Equity Market Mein Invest Hoti Hai. Flexi Cap Funds Mein Large Cap, Mid Cap, Aur Small Cap Ke Stocks Mein Money Invest Hoti Hai. Jab Market Mein Potential Opportunities Hoti Hain, Tab Flexi Cap Fund Ke Expert Managers Large Cap, Mid Cap, Aur Small Cap Ke Stocks Mein Portfolio Ko Adjust Karte Hain, Jisse Investors Ko High Returns Mil Sakte Hain. Is Flexi Cap Fund Ke Benefits Se Kai Log Flexi Cap Funds Mein Invest Karne Ka Decide Karte Hain. Flexi Cap Fund Mein Koi Nishchit Nahi Hota Hai Ki Large Cap, Mid Cap, Aur Small Cap Ke Stocks Mein Invest Hoga. Mutual Fund Ke Expert Managers Ko Lagta Hai Ki In Types Ke Stocks Mein Jyada Returns Milenge, To Unme Invest Karte Hain.

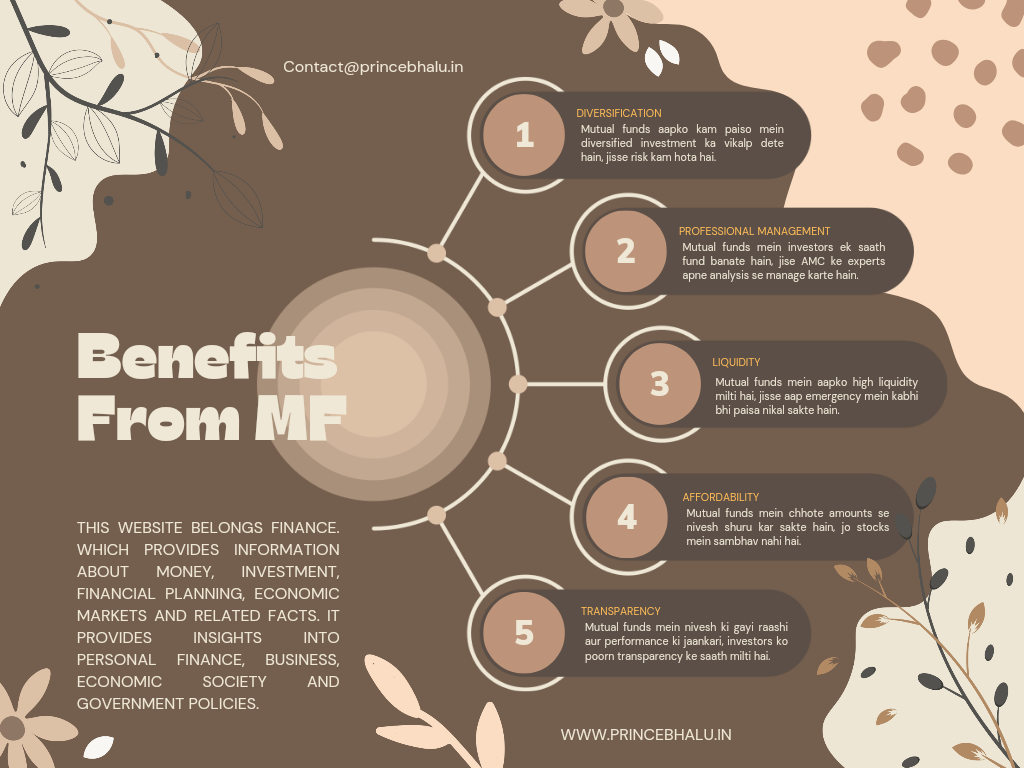

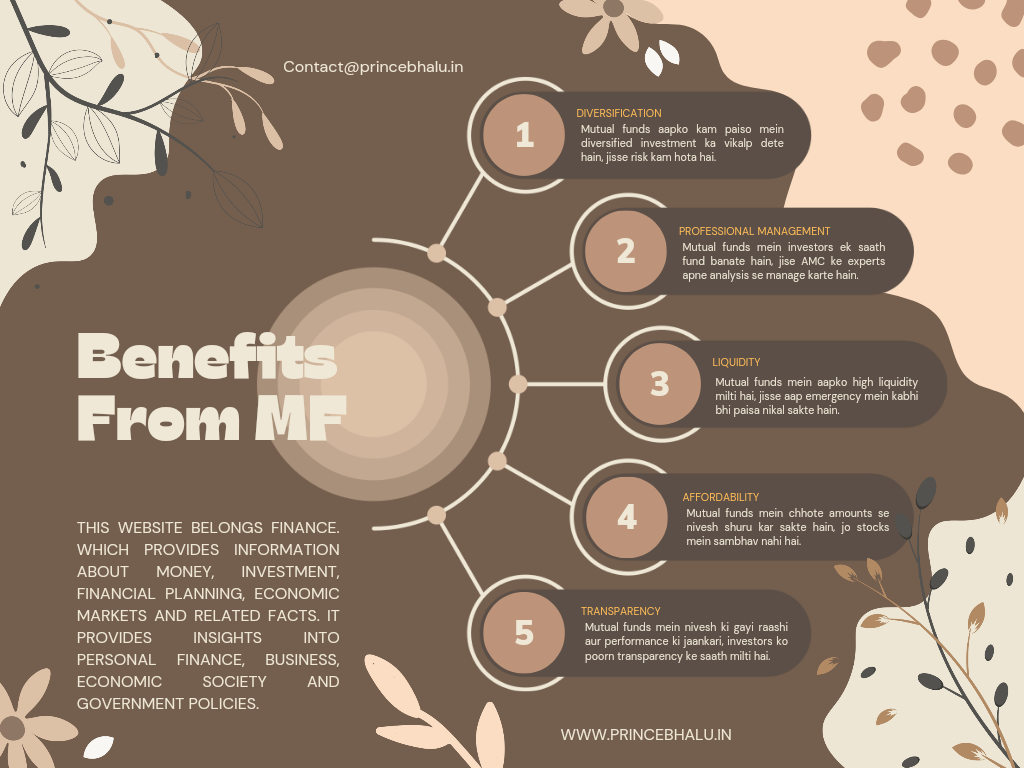

BENEFITS OF MUTUAL FUNDS

1. DIVERSIFICATION

Mutual Fund Mein Aap Thode Money Ko Bhi Diversified Tareeke Se Invest Kar Sakte Hain. Mutual Fund Mein Ye Fayda Hai Ki Aapki Investment Diversified Hoti Hai, Jo Ki Aap Stock Ko Individually Buy Karke Achieve Nahi Kar Sakte Kyunki Hamare Paas Itne Money Nahi Hote Ki Hum Sabhi Stocks Mein Invest Kar Sakein. Diversified Investment Mein Risk Kam Ho Jata Hai.

2. PROFESSIONAL MANAGEMENT

Kai Log Milke Mutual Fund Mein Invest Karte Hain Aur Ek Fund Banate Hain, Jise Hum Muchal Fund Kehte Hain. Uske Baad AMC Yaani Ki Asset Management Company Ke Expert Managers Un Fund Ko Apni Knowledge, Analysis, Research, Aur Experience Ka Istemal Karke Decisions Lete Hain Aur Investment Karte Hain. Isme Ye Fayda Hai Ki Expert Managers Aapke Money Ko Manage Karte Hain.

3. LIQUIDITY

Mutual Fund Mein Aap Jab Chahein Tab Exit Kar Sakte Hain, Kyunki Mutual Fund Mein Bahut Zyada Liquidity Hoti Hai. Agar Aapko Koi Emergency Fund Ki Zaroorat Hoti Hai, To Aap Apna Money Mutual Fund Se Nikal Sakte Hain.

4. AFFORDABILITY

Aap Mutual Fund Mein Small Amounts Money Se Bhi Investing Start Kar Sakte Hain. Jo Ki Aap Small Amounts Money Se Stock Mein Invest Nahi Kar Sakte Hain.

5. TRANSPARENCY

Mutual Fund Mein Aapko Dikhaya Jata Hai Ki Aapka Money Kahan Par Invest Hai. Matlab, Aapki Holding Kisme Invest Hai, Aur Aapke Mutual Fund Ki Performance Kaisi Hai, Ye Aapko Regular Intervals Par Pata Chalta Rahta Hai. Mutual Fund Mein Investors Ko Full Transparency Milti Hai.

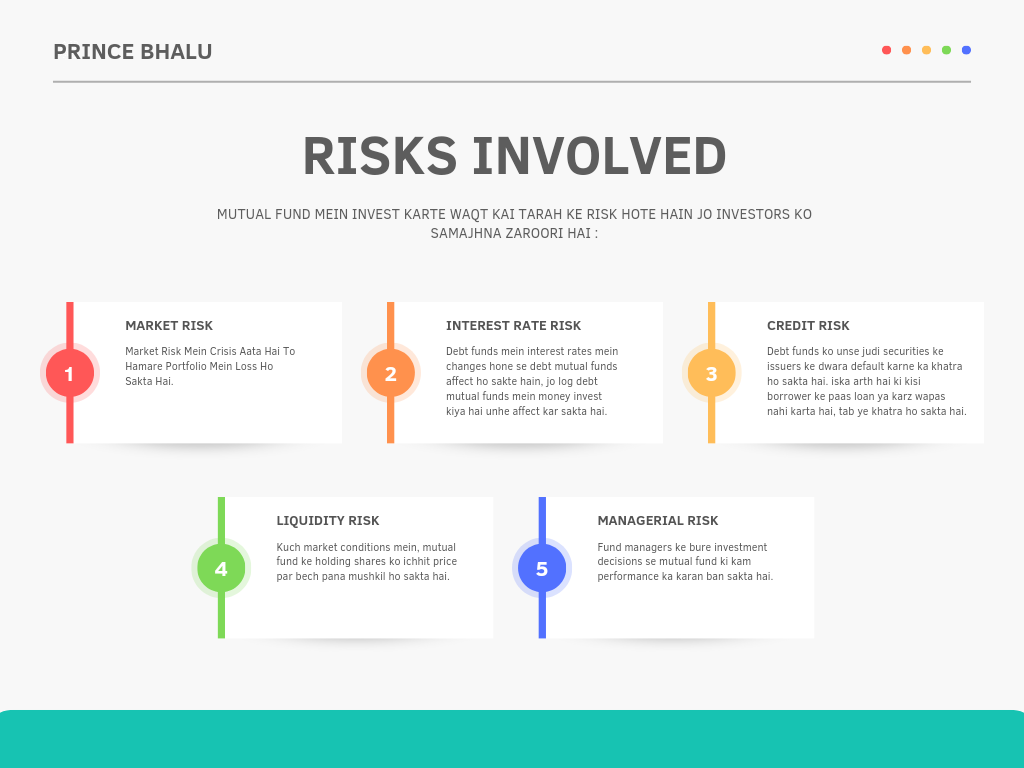

RISKS INVOLVED

Mutual Fund Mein Invest Karte Waqt Kai Tarah Ke Risk Hote Hain Jo Investors Ko Samajhna Zaroori Hai :

1. MARKET RISK

Market Risk Mein Crisis Aata Hai To Hamare Portfolio Mein Loss Ho Sakta Hai.

2. INTEREST RATE RISK

Debt Funds Mein Interest Rates Mein Changes Hone Se Debt Mutual Funds Affect Ho Sakte Hain, Jo Log Debt Mutual Funds Mein Money Invest Kiya Hai Unhe Affect Kar Sakta Hai.

3. CREDIT RISK

Debt Funds Ko Unse Judi Securities Ke Issuers Ke Dwara Default Karne Ka Khatra Ho Sakta Hai. Iska Arth Hai Ki Kisi Borrower Ke Paas Loan Ya Karz Wapas Nahi Karta Hai, Tab Ye Khatra Ho Sakta Hai.

4. LIQUIDITY RISK

Kuch Market Conditions Mein, Mutual Fund Ke Holding Shares Ko Ichhit Price Par Bech Pana Mushkil Ho Sakta Hai.

5. MANAGERIAL RISK

Fund Managers Ke Bure Investment Decisions Se Mutual Fund Ki Kam Performance Ka Karan Ban Sakta Hai.

In Sabhi Khatron Se Bachne Ke Liye, Investors Ko Apni Investment Policy Ko Samajhna Aur Uchit Tarah Se Mutual Fund Ki Investment Ko Diversify Mein Karna Chahiye.

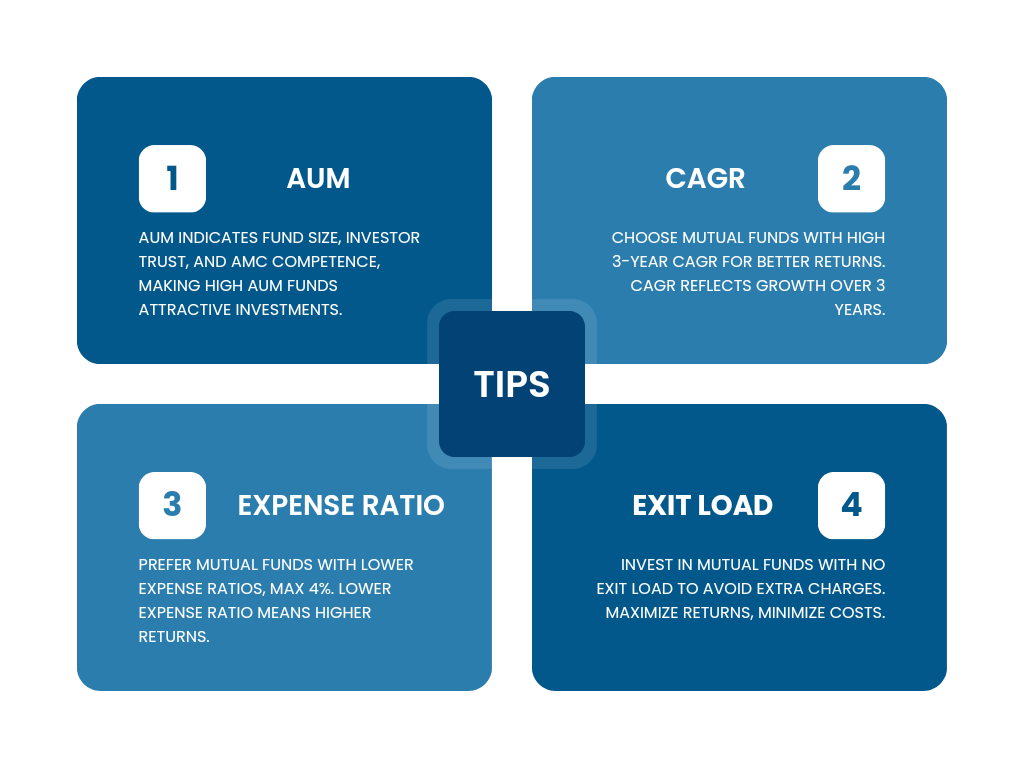

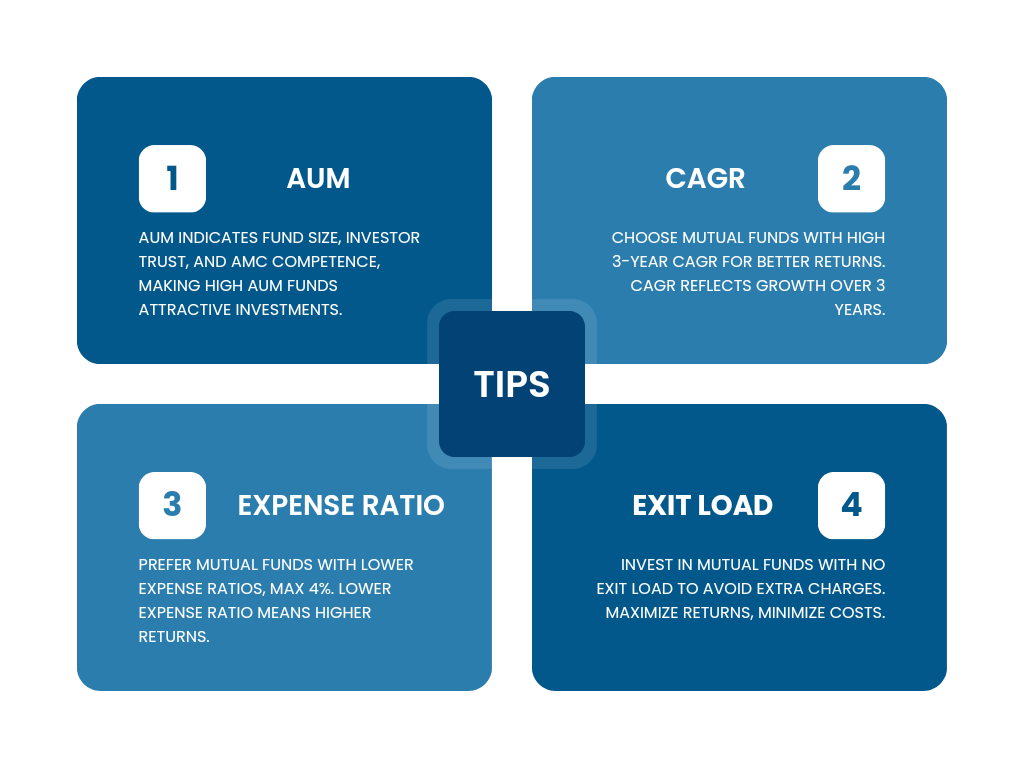

MUCHAL FUND INVESTMENT TIPS

- Jo Mutual Fund Ka AUM Jyada Hota Hai, Usme Aap Invest Karein. Kyunki Mutual Fund Ka AUM Batata Hai Ki Us Mutual Fund Mein Kitna Money Hai Aur Kitne Person Ne Us Mutual Fund Mein Money Invest Kiya Hai. AUM Yeh Bhi Batata Hai Ki Mutual Fund Ki Company AMC (Asset Management Company) Kitne Money Ko Manage Karti Hai.

- Aap Mutual Fund Ka 3 Years Ka CAGR Check Karein. Jo Mutual Fund Ne Jyada CAGR Diya Hai, Us Mutual Fund Mein Invest Karein. CAGR Yeh Batata Hai Ki Us Mutual Fund Ne 3 Years Mein Kitna Return Diya Hai.

- Mutual Fund Ki AMC Company Aapke Money Ko Invest Karke Return Laati Hai, Isliye Mutual Fund Ki AMC Company Aapse Fees Charge Karti Hai. Ye Charge Maximum 4% Tak Hota Hai. Unhe Expense Ratio Kehte Hain. Jo Bhi Mutual Fund Ka Expense Ratio Utna Kam Ho, Utna Accha Hai. Aur Jo Mutual Fund Ka Expense Ratio Kam Ho, Usme Invest Karein.

- Kuch Mutual Fund Mein Exit Load Bhi Hota Hai. Jab Aap Samay Se Pahle Apne Money Ko Nikalna Chahte Hain, Tab Aapko Exit Load Lagta Hai. Yeh Exit Load Maximum 4% Hota Hai. Jis Mutual Fund Mein Exit Load Na Ho, Us Mutual Fund Mein Invest Kar Sakte Hain.

CONCLUSION

Mutual Funds Ek Effective Investment Option Hai Jo Investors Ko Diversified Asset Mein Invest Karne Ki Suvidha Deta Hai. Sahi Tarah Se Chuna Gaya Mutual Fund Aapke Financial Goals Ko Achieve Karne Mein Madad Karta Hai Aur Long-term Wealth Creation Mein Madadgar Sabit Ho Sakta Hai. Isliye, Apne Financial Objectives Aur Risk Tolerance Ko Dhyan Mein Rakhte Hue Sahi Mutual Fund Chunne Mein Samay Vyatit Karna Zaruri Hai.