Table of Contents

Hamari Life Ke Most powerful Tool Ki Baat Karein Toh Voh Money Hai.

Jo Aap Money Ko Importance Nahi Dete, Unhe Duniya Respect Nahi Deti. Money Ko Earn Karna Padta Hai, Aur Usi Tarah Respect Ko Bhi Earn Karna Padta Hai.

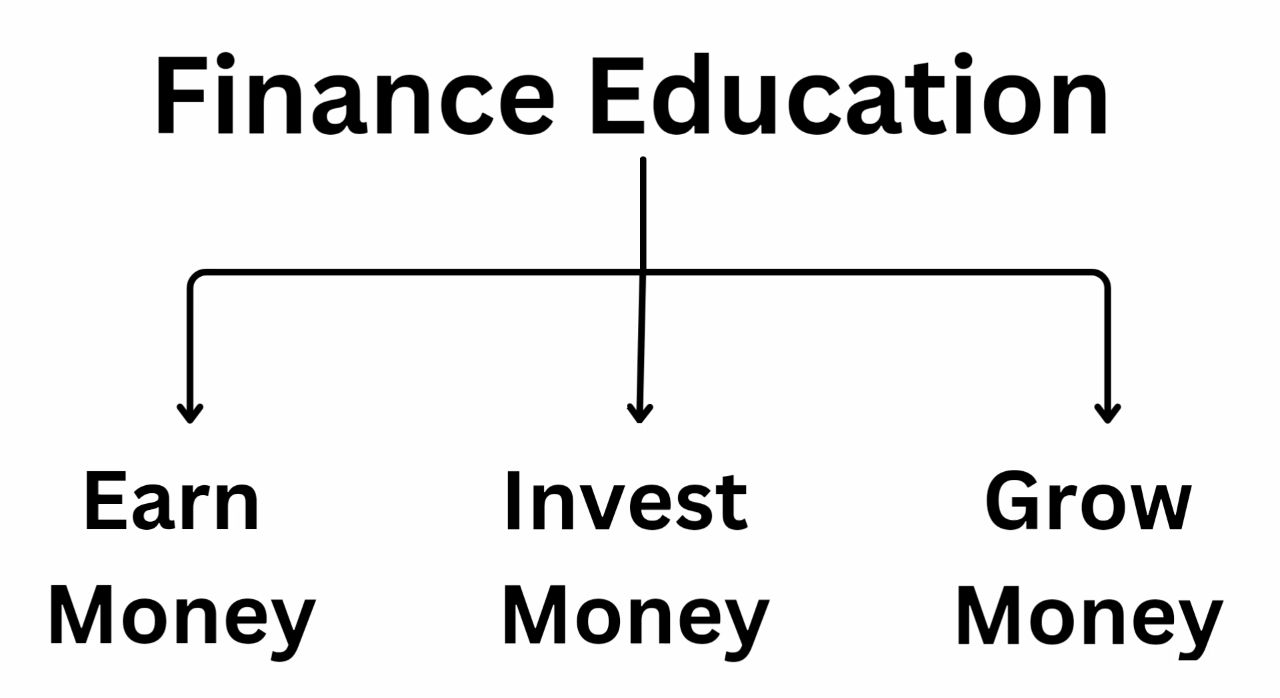

Aap Rich Ho Ya Fir Middle Class Se Ho Ya Fir Aap Poor Ho, Aapko Rich Banana Hai To Finance Education Seekhna Padega. Aata Hai To Aapko Aur Seekhna Padega, Jisse Ki Aapki Financial Condition Jo Aaj Hai, Vo Future Mein Behtar Bane. Jo Aaj Aap Lifestyle Maintain Karte Ho, Usse Future Mein Aur Bhi Acchi Tarah Se Maintain Kar Sako.

Agar Aapko Rich Banna Hai, Toh Aapko Aset Aur Liabilitiy Ka Antar Samajhna Hoga. Aap Aset Ko Badhayein Aur Hamesha Liabilitiy Ko Kam Rakhein. Aset Ka Matlab Hai Ki Aapki Jeb Mein Money Aata Hai. Liabilitiy Ka Matlab Hai Ki Aapki Jeb Se Money Jaata Hai. Aset Ko Hindi Mein ‘sampatti’ Kehte Hain Aur Liabilitiy Ko ‘dayitv’ Kehte Hain.

Asit Ke Examples Ki Baat Karein, To Fd Ho Gayi. Ya Fir, Aapka Ghar Inmein Apko Apki Jeb Mein Money Aata Hai. Yaad Rakhein Ki Agar Aap Apna Ghar Rent Par Dete Hain, To Vo Apke Liye Ek Aset Hai. Varna, Agar Aap Usi Ghar Mein Rehte Hain, To Vo Apke Liye Ek Liability Hai.

Liability Ke Examples Ki Baat Karein, To Apki Car Ya Fir Apki Bike Ho Gayi. Inmein Se Apke Jeb Se Money Jata Hai Kyunki Inka Maintenance Karna Padta Hai Aur Har Baar Petrol Ya Diesel Dalvana Padta Hai. Isliye, Apka Money Apki Jeb Se Jata Hai.

FINANCE EDUCATION 3 STEPS

1. First Step : Earn Money

2. Second Step : Invest Money

3. Third Step : Grow Money

1. First Step : Earn Money

First Step Ki Baat Karein Toh Usmein Aapko Money Earn Karna Hoga.

Yaad Rakhein Ki Money Earn Karna Mushkil Hota Hai, Aasan Nahi.

Life Mein Hamesha Dukh Aur Sukh Aate Hain. Yaad Rakhein Ki Dukh Aur Sukh Temporary Hote Hain. Agar Aapko Permanent Sukh Chahiye Toh Aapko Brain Ke Saath Hardwork Karna Padega.

Yaad Rakhein Ki Koi Bhi Apna Money Aapko Kyun Dega, Aap Unko Value Denge Toh Money Dega.

Money Kamane Ki Baat Karein Toh Aap In Tareeko Se Money Kama Sakte Hain :

Job Ya Apna Business Start Karke.

2. Second Step : Invest Money

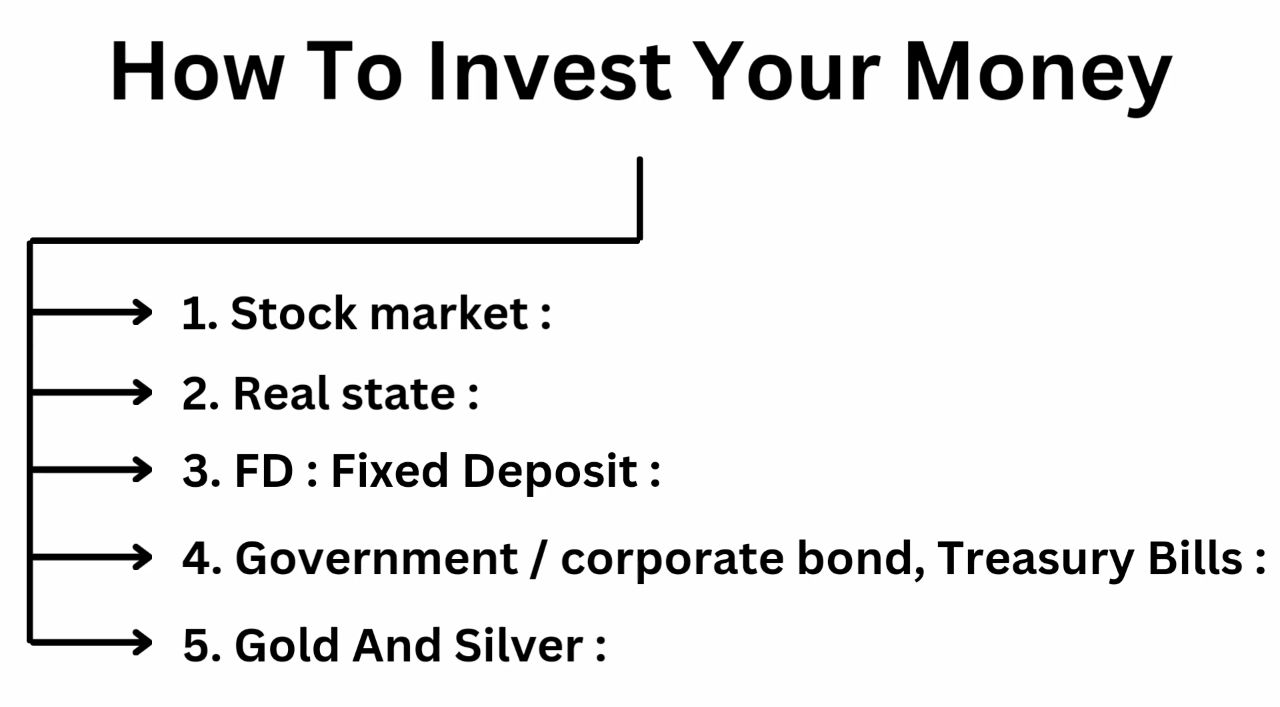

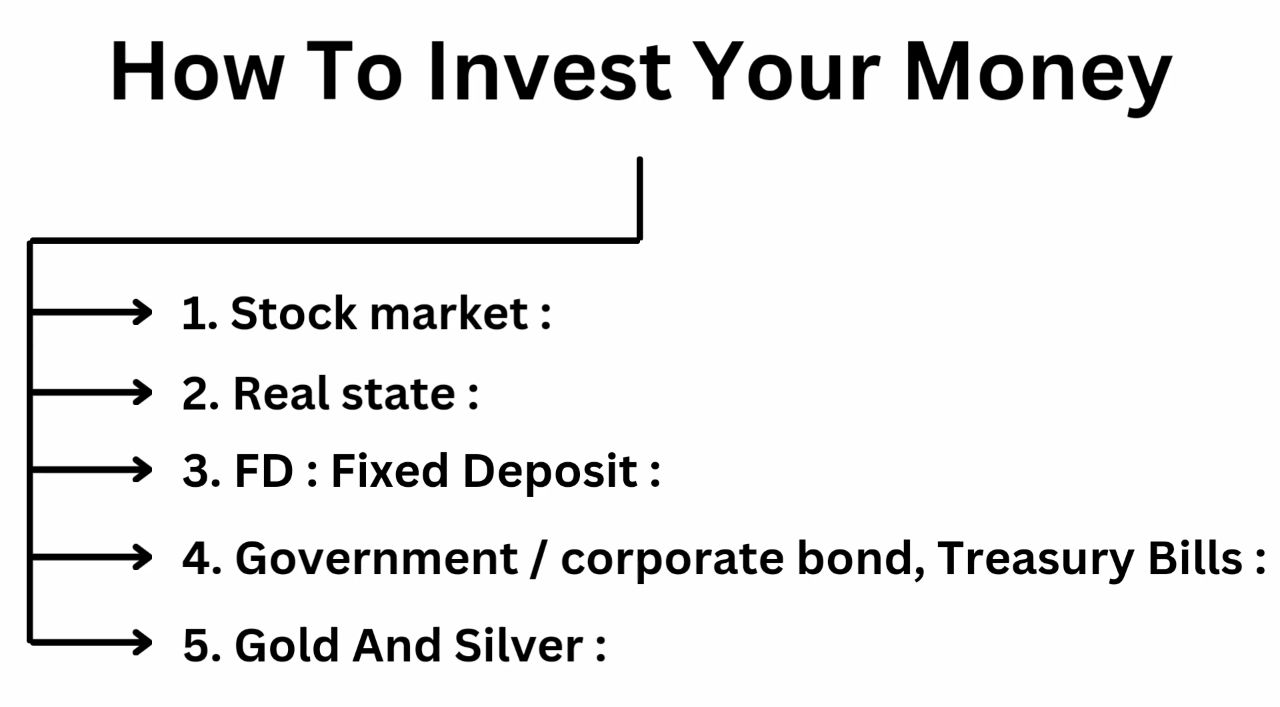

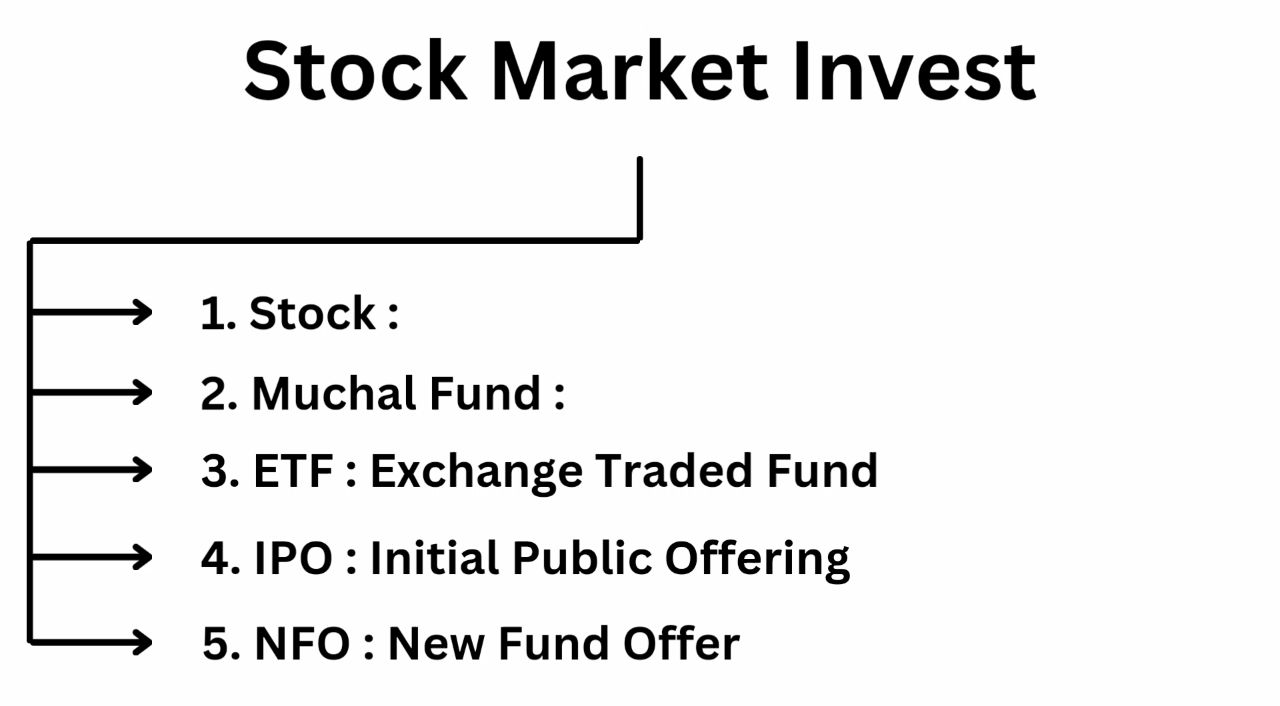

Second Step Ki Bat Kare To Vo He Invest Money Aap Kin Kin Jagavo Par Apna Money Invest Kar Shakte Hai. Vese To Kahi Sari Jaga Par Invest Kar Shakte Hai. Ae Blog Me Apko 5 Jagovo Par Invest Karneka Tarikha Bataya Hai

1. Stock Market

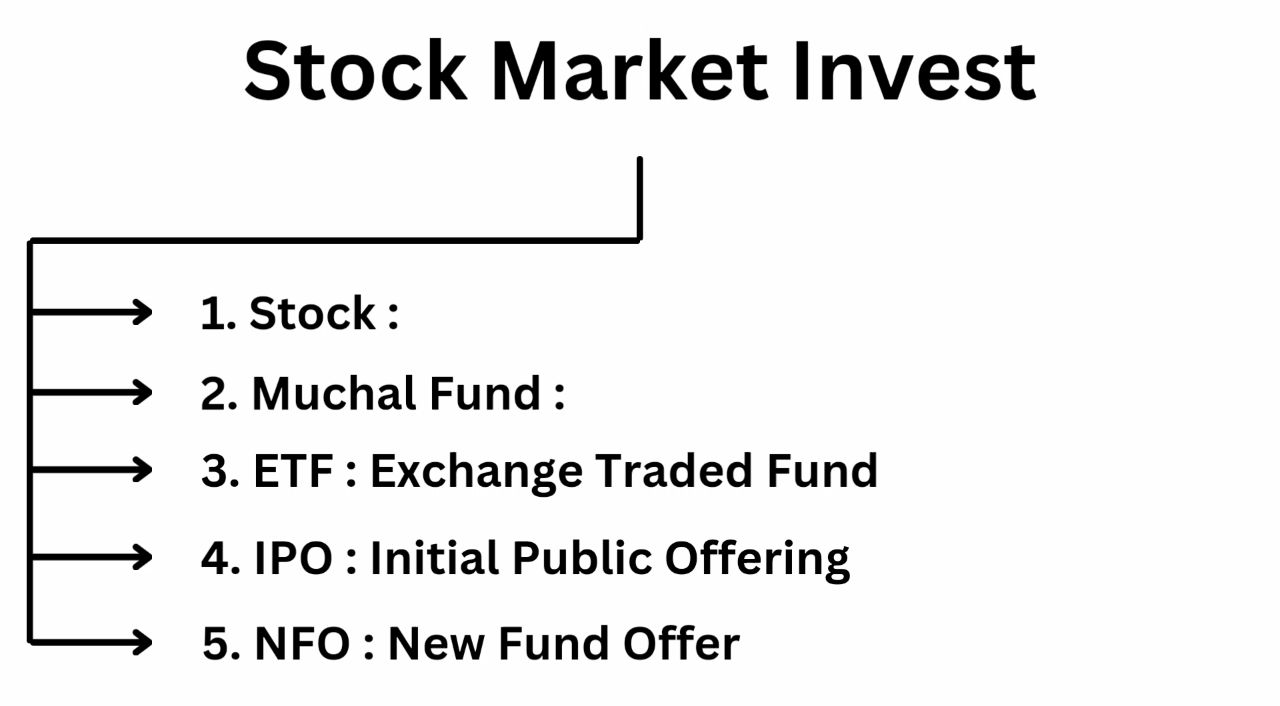

Sabse Pehle Tareekhe Ki Baat Karein Toh Vo Hai Stock Market. Agar Aapko Stock Market Ki Knowledge Nahi Hai Toh Aap Mutual Fund Ya Fir ETF Mein Invest Kar Sakte Hain. Stock Market Mein Aap Kis Kis Jagah Par Invest Kar Sakte Hain.

1. Stock :

Stock Market Mein First Investment Karne Ki Baat Karein To Aap Achhi Company Ke Stocks Mein Invest Kar Sakte Hain.

2. Muchal Fund :

Stock Market Mein Second Invest Ki Baat Karein To Aap Mutual Fund Mein Invest Kar Sakte Hain. Stock Ki Comparison Mein Mutual Fund Safe Investment Hai. Mutual Fund Ko AMC Yaani Ki Asset Management Company Mutual Fund Ko Manage Karti Hai.

3. ETF :

Stock Market Mein Third Invest Ki Baat Karein Toh Woh Hai ETF.

ETF Ko Exchange Traded Fund Kahte Hai. ETF Muchal Fund Jesa Hi Hota Hai.

4. IPO :

Stock Market Me Four Invest Ki Baat Karein To Voh Hain IPOs. IPO Ka Matlab Hota Hai Initial Public Offering.

Jab Bhi Kisi Company Ko Apna Business Expand Karna Ho Ya Koi Bhi Reason Se Apni Company Ko Develop Karna Ho, Tab Company Apna Share Market Mein Laati Hai. Usay Hum IPO Kehte Hain. Agar Company Ko Profit Hota Hai, To Aapko Bhi Profit Hota Hai. Aur Agar Company Ko Loss Hota Hai, To Us Case Mein Aapka Bhi Loss Hota Hai.

5. NFO :

Stock Market Mein Five Invest Karne Ki Baat Karein Toh Voh Hai NFOs. Mutual Fund Apna NFO Issue Karta Hai. NFO Ko New Fund Offer Kehte Hain. Achhe Mutual Fund Ke NFOs Mein Invest Kar Sakte Hain.

2. Real Estate

Real Estate Mein Flats, Apartments, Villas, Aur Shops Shamil Hote Hain. Is Sector Ne Investors Ko Kaafi Accha Return Diya Hai. Real Estate Ki Prices Over The Years High Hui Hain. Future Mein Bhi Real Estate Ki Prices High Hone Ki Possibility Hai. Isliye Ise Achha Investment Mana Jaata Hai.

Agar Aapke Paas Money Ho, To Real Estate Mein Invest Kar Sakte Hain. Agar Aapke Paas Itna Money Nahi Hai, To Aap Real Estate Ke Mutual Fund Ya Fir ETF Mein Invest Kar Sakte Hain.

3. FD

Third Investment Ke Baare Mein Baat Karein Toh Woh Hai Bank Mein FD Karvana. FD Ko Fixed Deposit Kehte Hain.

4. Government Bond‚ Treasury Bills Aur Corporate Bond

Four Investment Ke Baare Mein Baat Karein Toh Woh Hai Government Bond, Treasury Bills, Aur Corporate Bond.

Jab Government Ko Railway Yatra, Bus Yatra Ya Kisi Bhi Project Ko Start Karna Hota Hai, Tab Government Ko Money Ki Zaroorat Hoti Hai. Is Samay, Government Public Se Money Udhaar Leti Hai Aur Iske Liye Government Government Bond Issue Karti Hai.

Treasury Bills Bhi Government Bonds Ki Tarah Hote Hain, Lekin Sirf Central Government Hi Inhe Issue Kar Sakti Hai. State Government Treasury Bills Issue Nahi Kar Sakti Hai. Treasury Bills Ki Maturity Period 1 Year Se Kam Hoti Hai. Bank FD Se Zyada Returns Government Bond Ya Treasury Bills Mein Milta Hai Aur Ye Bhi Bank FD Se Zyada Secure Hote Hain.

Corporate Bond Bhi Government Bonds Jaisa Hota Hai, Lekin Ye Private Companies Issue Karti Hain. Corporate Bond Mein Kisi Bhi Company Ko Apna Development Karne Ke Liye Money Chahiye Hota Hai, Aur Isliye Wo Public Se Money Udhaar Leti Hai, Jise Corporate Bond Kehte Hain.

5. Precious Metal

Five Investment Karne Ki Baat Karein Toh Voh Hi Precious Metals Hain. Precious Metals Mein Gold Ya Fir Silver Mein Invest Kiya Ja Sakta Hai.

Agar Aapke Paas Itne Money Nahi Hain Toh Aap Gold Ya Fir Silver Ke Mutual Fund Ya Fir ETF Le Sakte Hain. Kayi Sadiyon Se Hi Gold Ya Silver Achi Investment Maani Jaati Hai. Aap Digital Gold Bhi Le Sakte Hain, Jise Aapko Gold Ko Preserve Karne Ki Zarurat Nahi Padti. Aur Chori Ka Bhi Dar Nahi Hota.

3. Third Step : Grow Money

Aapke Money Ko Jitna Ho Sake, Utna Adhik Se Adhik Returns Laane Ki Koshish Karen.

Life Mein Sab Kuch Sirf Money Nahi Hai. Jo Person Yeh Kehte Hain, Woh Galat Hain. Kyunki Aapko Yaad Rakhna Chahiye Ki Aapke Maa-baap Ne Apne Dhan Ko Kamane Ke Liye Adhik Se Adhik Jeevan Bitaya Hai.

Aapko Apne Money Ko Kitne Years Mein Do Guna Hoga, Iska Pata Karne Ke Liye ‘Rule Of 72’ Hai.

Isse Hum Ek Example Se Samajhte Hain. Maan Lijiye Aapko Ek Years Mein 12% Ka Return Milta Hai. To Aapko 72 Se 12 Divide Karna Hoga. To Aapka Answer Aayega 6. Iska Matlab Hai Ki Aapke Money Ko 6 Years Mein Do Guna Ho Jayega.

= 72 / 12

= 6