Table of Contents

Stock Se Stock Market Banta Hai.

Stock Market 9:15 AM Se Open Hota Hai Aur 3:30 PM Tak Close Hota Hai.

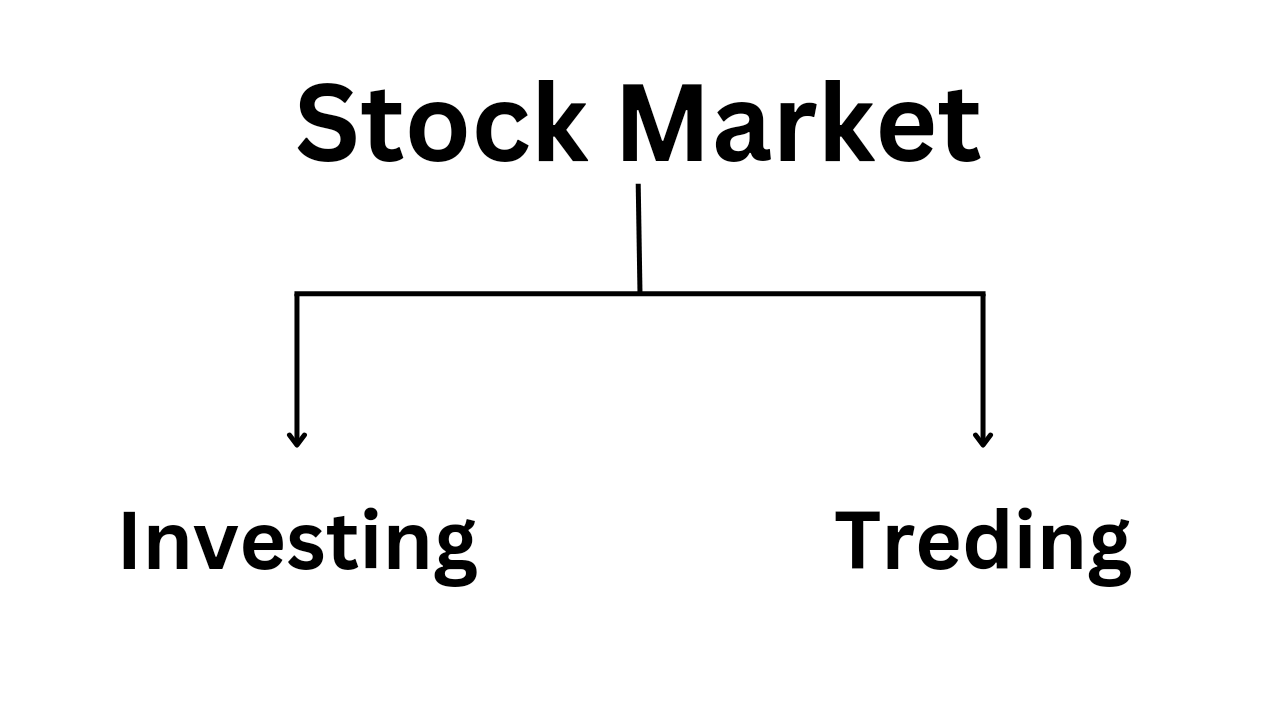

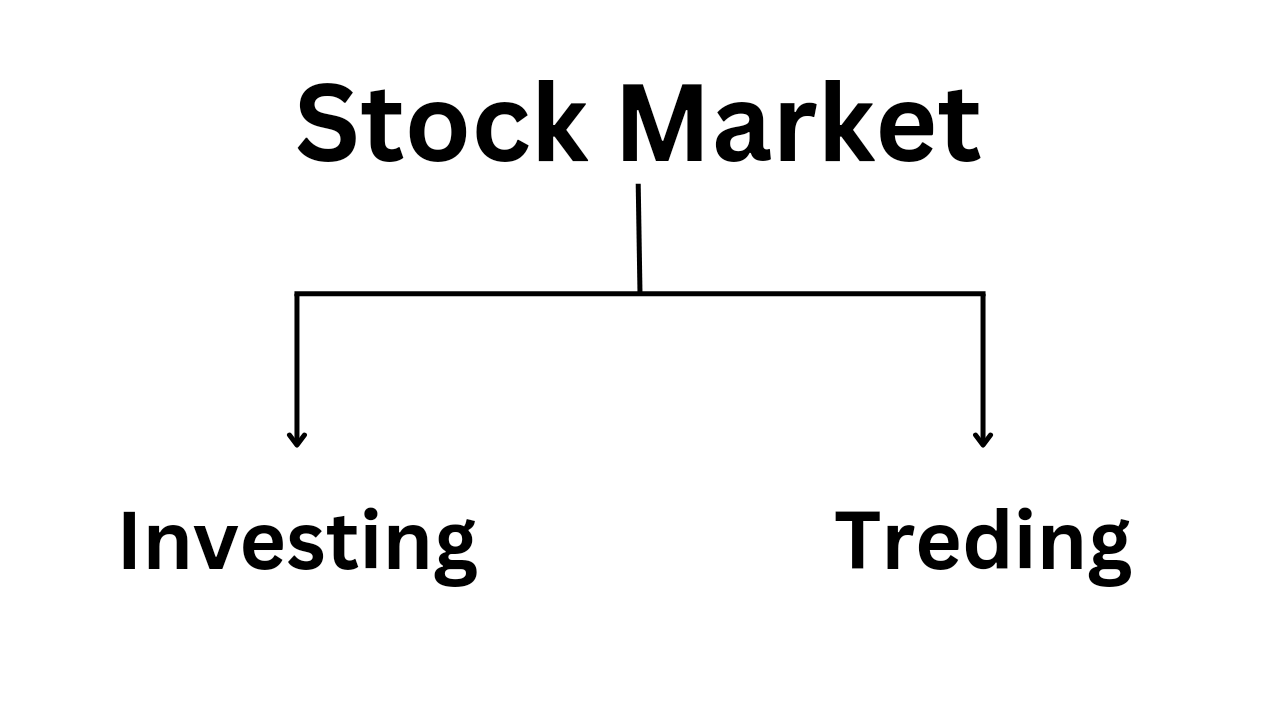

Stock Market Mein Aap Investing Ya Fir Trading Kar Sakte Hain.

1. Investing :

2. Treding :

Aap Stock Market Mein Beginners Hain, Toh Aap Investing Se Shuru Karein.

Investing Mein Apko Fundamental Analysis Aur Technical Analysis Karna Padega.

Trading Mein Sirf Technical Analysis Ki Zarurat Hoti Hai.

Agar Aap Beginners Hain Toh Treding Nahin Karni Chahiye.

INVESTING

Agar Stock Market Ki Knowledge Nahin Hai Toh Aap Mutual Fund Ya Fir ETF Mein Invest Kar Sakte Hain.

Stock Market Mein Aap Yahan Par Invest Kar Sakte Hain :

1. STOCK

Stock Market Mein Sabse Pehle Invest Karne Ki Baat Karein, Toh Aap Acchi Company Ke Stock Mein Invest Kar Sakte Hain.

2. MUCHAL FUND

Stock Market Mein second Invest Karne Ka Option Hai, Aap Mutual Fund Mein Invest Kar Sakte Hain. Stock Ki Comparison Mein Mutual Fund Safe Investment Hai. Mutual Fund Ko AMC (Asset Management Company) Manage Karta Hai.

3. ETF

Stock Market Mein third Invest Karne Ka Option Hai, Aap ETF Mein Invest Kar Sakte Hain.

ETF Ko Exchange Traded Fund Kehte Hain. ETF Mutual Fund Jaisa Hi Hota Hai.

4. IPO

Stock Market Mein four Invest Karne Ka Option Hai, Vo Hai IPO. IPO Ko Initial Public Offering Kehte Hain.

Jab Kabhi Bhi Kisi Company Ko Apna Business Growth Karna Hota Hai Ya Fir Koi Bhi Reason Se Apni Company Ko Develop Karna Hota Hai, Tab Company Apna Share Issue Karti Hai. Usse IPO Kehte Hain. Company Ko Profit Hota Hai Toh Aapko Bhi Profit Hota Hai. Aur Company Ko Loss Hota Hai Toh Us Case Mein Aapka Bhi Loss Hota Hai.

5. NFO

Stock Market Mein five Invest Karne Ka Option Hai, Vo Hai NFO. Mutual Fund Apna NFO Issue Karta Hai. NFO Ko New Fund Offer Kehte Hain. Achhe Mutual Fund Ke NFO Mein Invest Kar Sakte Hain.

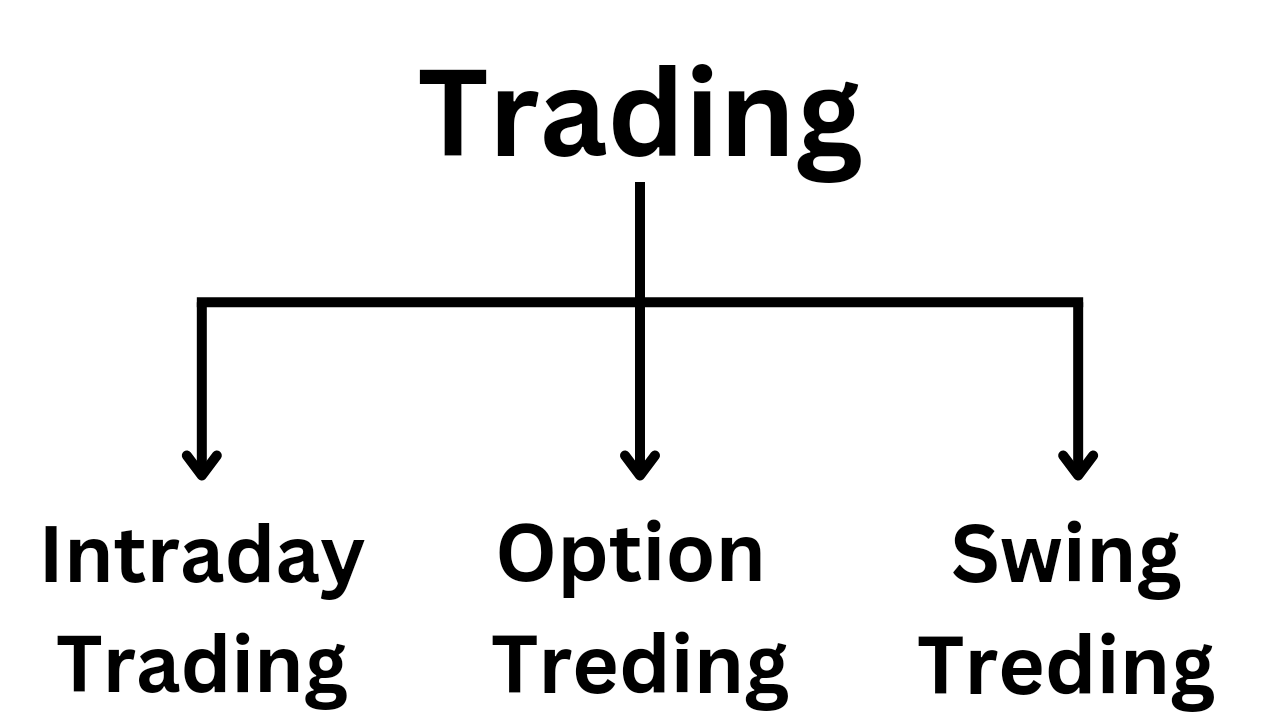

TRADING

Agar Aap Beginner Hain Toh Aap Swing Trading Se Shuruat Karein.

1. INTRADAY TRADING

Intraday Trading Stock Mein Hota Hai. Intraday Trading Mein 1 day Mein Stock Ko Buy And Sell Karna Hota Hai. 1 day Mein Trader Ko Profit Book Karna Hota Hai.

Intraday Trading Mein Apko 5x Ka Margin Milta Hai.

Example :

Agar Aap Intraday Trading Mein ₹50,000 Ka Stock Buy Karna Chahte Hain Toh Us Case Mein Apko Sirf ₹10,000 Hi Lagega. Kyunki Intraday Trading Mein Aapko 5x Ka Margin Milta Hai.

₹50,000 Ka Stock Se Intraday Trading Shuru Karte Hain. Usme Apko 10% Ka Profit Ya Fir 10% Ka Loss ₹5,000 Hota Hai.

Apne ₹10,000 Hi Lagaya Tha, Lekin ₹5,000 Ka (50%) Profit Bhi Hota Hai. ₹5,000 (50%) Ka Loss Bhi Hota Hai.

2. OPTION TREDING

Option Trading Mein Aap Koi Bhi Stock Buy And Sell Nahi Karte. Option Trading Mein Aap Contract Ko Buy And Sell Karte Hain.

Option Trading Mein Apko Contract Ke Premium Ko Buy And Sell Karna Hota Hai.

Option Trading Mein Premium Mein Intrinsic Value + Time Value Hoti Hai.

Intraday Trading Mein 1 Stock, 2 Stock, 10 Stock, Ya Fir 20 Stock Ko Buy And Sell Karte Hain.

Option Trading Mein Apko Lot Size Ko Buy Karna Hota Hai. 150 Stock Mein Option Trading Kar Sakte Hain. Usme Nifty Aur Bank Nifty Mein Zyada Tar Option Trading Hoti Hai.

Nifty Aur Bank Nifty Ki Price High Hogi, Tab Aapne Option Trading Mein Call Option Buy Kiya Hai. Tab Contract Ke Premium Ki Price High Hogi.

Agar Aapne Option Trading Mein Put Option Buy Kiya Hai Aur Nifty Aur Bank Nifty Ki Price High Hogi, Tab Contract Ke Premium Ki Price Low Hogi.

Intraday Trading Mein Aapko 1 Day Mein Stock Ko Buy And Sell Karna Hota Hai, Lekin Option Trading Mein Expiry Hoti Hai.

Vo Expiry Weekly Bhi Hoti Hai Aur Monthly Bhi Hoti Hai.

Option Trading Mein High Risk Hota Hai Aur High Reward Hota Hai.

3. SWING TREDING

Swing Trading Mein Low Risk Hota Hai Aur Low Reward Hota Hai.

Swing Trading Mein Aap Jab Chahe Tab Sell Kar Sakte Hain.

Swing Trading Mein Time Ki Limit Nahi Hoti.

Swing Trading Mein Jaise Aap Normal Stock Ko Buy And Sell Karte Hain, Vaise Hi Swing Trading Mein Aap Stock Ko Buy And Sell Karte Hain.